Account Services

Additional services provided as a convenience to our members.

Prepaid Card or Gift Cards

VISA Gift Cards

It is easy to check the balance remaining on your card by calling 866-833-2370 or by logging in to your card online.

VISA Travel Card

Cashier's Checks

One free per day (members only). $3.00 charge for each additional check or for non-members. Payee name required.

Money Orders

Up to maximum of $1,000. A fee of $3.00 per money order is charged.

Night Deposit

Securely leave your deposit with us at any time outside of our normal business hours.

Drop box locations:

- Franklin - next to the ATM outside of the branch

- Downtown - next to the credit union main entrance

Overdraft Protection

Running short on funds in your checking? Overdraft protection has you covered. Funds will transfer from your savings in the event of an overdraft. $1 transfer fee applies.

Telephone Banking

24-hour access to account information and transfers from a touch-tone phone. Call 414-665-2992 or 800-508-9670 (Access Code Required).

Notary Public

- I.D. required

- Notarize Signature – No Charge

- Notary Certification of Authenticity - $.50/page

Signature Guarantee

- Credit union members only

- I.D. required

- Appointment required

- Proof of ownership required (statement of account, deed, etc.)

- Dollar limitations apply

Postage Stamps

Sheets of twenty Forever stamps available for $14.60

Wire Transfers

The credit union provides wire transfer services to financial institutions across the country, as well as internationally (some restrictions may apply). We can also receive wire transfers for credit to our members' accounts. For outgoing wire transfers, accurate wiring instructions from the institution receiving the funds are a must. For your protection, outgoing wires must be requested in person at the credit union office. Telephone requests will not be accepted. Use the wire transfer form to initiate your wire. The cutoff time for outgoing wires is 2:00 p.m.

Wire Fees

| Type | Cost |

|---|---|

| Domestic Wire | $15.00 |

| Foreign Wire | $50.00 |

| Incoming Wire | $7.50 |

Incoming Wire Instructions

| Field | Information |

|---|---|

| Wire To: | Corporate Central Credit Union |

| Further Credit To: | Northwestern Mutual Credit Union |

| Final Credit To: | Member's Name |

Direct Deposit

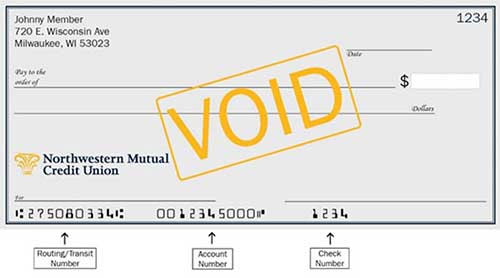

Direct Deposit is a convenient, secure way to deposit your paycheck, pension or government funds. To establish direct deposit, provide your Human Resources, Payroll Department, or check issuer with your NMCU account number in a 5 or 6-digit format, along with our routing and transit number (275080334).

If you need help finding your NMCU account number, please call 414-665-3423.

Here’s how to find your Routing and Account Number:

Other Money Services

Payroll Deduction

NM payroll deduction is a convenient way to make your loan payments or create a savings plan. To establish a new deduction or change your existing deduction, stop in the credit union office. We'll take care of everything!

Automated Clearing House (ACH) Transactions

To initiate direct deposit or an automatic deduction to/from your checking or savings you will need:

- NMCU Routing and Transit Number: 275080334

- Your Credit Union Account Number: *use your 5 or 6-digit member number*

You will be asked by the originator whether you want the item to be posted to checking or savings. The customer name associated with the transaction must be an owner on the account affected or the transaction will be rejected.

Have Questions?

Feel free to reach out with any questions.